The Best Guide To Retirement Calculators - Lord Abbett

The NEA Retirement Income Calculator - NEA Member Benefits

Retirement Calculator - Hess Financial Coaching

Indicators on Early Retirement Calculator - Networthify.com You Need To Know

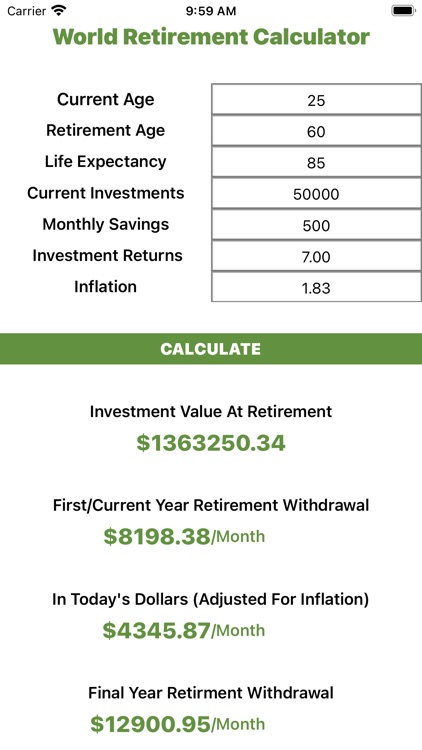

Retirement calculator: How we got here, Our totally free calculator anticipates your retirement savings, and after that estimates how it would extend over your retirement in today's dollars, taking inflation into account. Our default assumptions consist of: Raises of 2% each year. A 5% rate of return in retirement (assuming a more conservative portfolio).

If you wish, you can go into more details in the Optional settings, such as your anticipated rate of return prior to retirement and what you anticipate from Social Security (get an estimate here). You can likewise fine-tune your retirement costs level, retirement age and more. Wish to enhance your rating? Here's how, Here are some methods to increase your retirement readiness whether you're behind on your objectives or are on track however possibly desire to retire a little earlier."My rating needs attention."An individual retirement account is among the most popular methods to conserve for retirement given its big tax advantages.

And if you're 50 or older, you can contribute an additional $1,000 a year. Discover more about IRAs"On my method, but I might close the space."The annual limit for 401(k) contributions is $19,500 (plus an additional $6,500 for those 50 and up). It's smart to a minimum of contribute approximately the point where you're getting all of the matching dollars your employer may offer.

Unknown Facts About Retirement Pension Estimator - Mass.gov

And they're not as pricey as you may believe. Find out how to choose a financial consultantHow much cash do you need to retire? A typical standard is that you should intend to change 70% of your annual pre-retirement earnings. This is what the calculator utilizes as a default. You can change your pre-retirement income using a combination of savings, investments, Social Security and any other income sources (part-time work, a pension, rental earnings, etc).

It's essential to think about how your expenses will alter in retirement. https://pastebin.pl/view/198d5ab8 , like healthcare and travel, are most likely to increase. But numerous repeating expenditures could decrease: You no longer need to commit a part of your income to saving for retirement. You might have settled your home mortgage and other loans.